We often have car accident victims come into our office seeking our assistance to help them recover compensation for their property damage, medical bills, injuries, and pain and suffering. Sometimes, however, our clients are their own worst enemies because they have purchased bad auto insurance policies that subsequently handcuff our Firm’s ability to recover the highest settlements possible for them. The most common example is when a client has been rear-ended by an uninsured driver and the client only has one-way (liability) insurance.

To that end, here are guidelines that you should keep in mind when you are shopping around for the right auto insurance policy.

Do Not Buy Policies from Sleazy Auto Insurance Companies.

You know those insurance companies. They’re the ones with radio commercials that promise to give you liability insurance for your car or motorcycle for only $13.00 a month. Or if you want two-way coverage, they’ll give you quotes as low as $30 a month. If it sounds too good to be true, that’s because it is.

In the world of auto insurance policies, you get what you pay for. Once you have a policy with one of those sleazy auto insurance companies, you’ll inevitably be cursed with extremely poor customer service. The $30-per-month premium may sound extremely enticing, but what happens when you actually get into an accident? After you get into an accident, these companies make it near impossible for you to open up a claim to fix your car or to get medical treatment. Expect to be put on hold every time you need to call an adjuster. Being put on hold for half an hour to an hour is commonplace with these insurance companies. Sometimes, the call will mysteriously cut off after you’ve already been on hold for an hour. And when your call is finally patched through to your insurance adjuster, you end up getting his/her voicemail. The end result is that it often takes multiple days or even weeks before your insurance company will inspect your car, much less begin the repair process. As for your medical bills, don’t be surprised if these companies deny your injury claims despite you having a medical payment provision on your auto policy. But as we stated earlier, you get what you pay for.

And what happens if the accident is your fault? Those sleazy auto insurance companies will do little to nothing to protect you from the other driver if he/she decides to file a claim against you for your negligence. This is the reason why drivers with policies from these fourth-rate auto insurance companies often get sued; because these auto insurance companies don’t do enough to protect their policyholders.

Buy an auto policy from trusted companies such as State Farm, Allstate, GEICO, Liberty Mutual, Progressive, etc. instead. Unfortunately, these trusted top 15 auto insurance companies will not offer you one-way policies for $13 a month or two-way policies for $40 a month. (Remember: you get what you pay for). However, if you do your research, you’ll find that there is a wide price differential in terms of monthly auto insurance premiums among the top 15 auto insurance companies. If you do your due diligence, you’ll find a policy with a trusted auto insurance company that you can afford.

While their monthly premium prices will vary, what all these companies have in common is that they provide excellent customer service to their policy holders. Unlike with the bottom-of-the-barrel insurance companies mentioned above, you will actually be able to contact your insurance adjuster when you need them most. As a result, setting up vehicle inspections, car repairs, car rentals, and getting your medical bills compensated through these insurance companies is relatively painless and efficient. Moreover, these trusted insurance companies do not frivolously deny claims as much as the low-quality insurance companies deny claims. Equally important, these insurance companies will often pay out more generously for injury claims than the bottom-of-the-barrel insurance companies mentioned above.

Building the Right Auto Insurance Policy so that You are Protected in Case of an Accident.

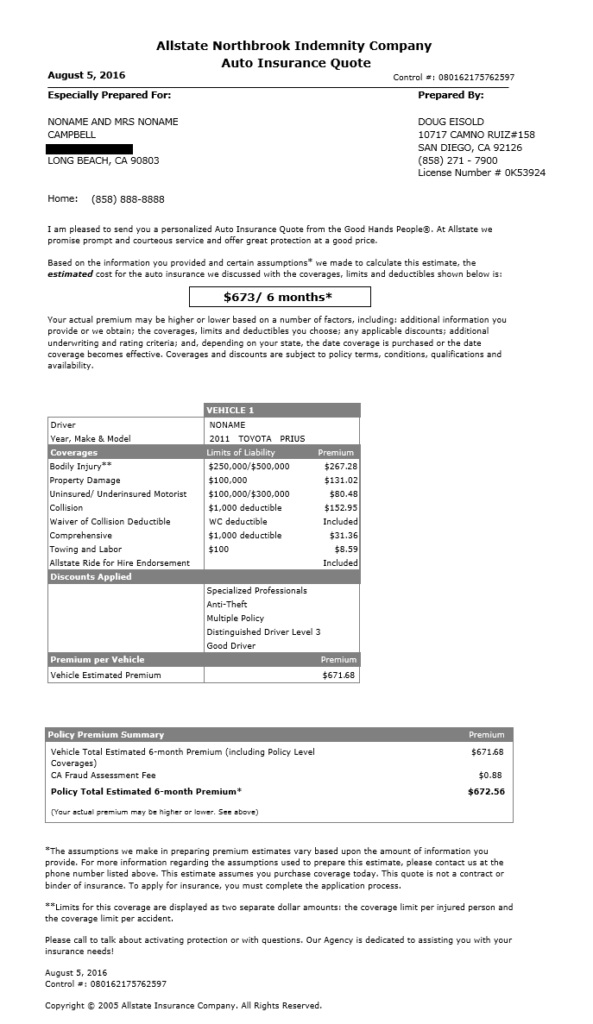

The picture above is a sample auto insurance policy for a 2011 Toyota Prius. As you can see, the coverages you can purchase for your auto policy include but are not limited to bodily injury, property damage, uninsured/underinsured motorist, collision, and comprehensive. Confused? Don’t worry. Allow us to explain each coverage and how they can protect you in case of a car accident.

Bodily Injury: This coverage is also referred to as bodily injury liability. This coverage is responsible for paying for the bodily injury claims of anyone who is injured as a result of a car accident that is your fault. The $250,000 / $500,000 numbers above reflect the maximum amount of money (the policy limit) that the insurance company would be willing to pay out to parties (not including yourself) injured in the accident. The first number ($250,000) represents the maximum amount that any individual injured party could obtain to satisfy their bodily injury claim, whereas the second number ($500,000) represents the total amount that your insurance company would pay out to all injured parties. For example, if you rear-end someone and two people are seriously injured in the other car, each of them can obtain a maximum bodily injury settlement of $250,000 each and a total of $500,000 for both parties. For that reason, the bodily injury policy shown above is an excellent policy.

In contrast, the minimum bodily injury liability policy required by California law for automobile drivers is $15,000 per injured person / $30,000 total per accident.

You should consider buying a higher policy than $15K / $30K. If you cause a car accident that results in more than $30,000 in bodily injury damages to the injured parties, your insurance company will likely deny any bodily injury claim that is over $30,000 (the policy limit); which would likely result in the injured parties suing you personally and directly. That would be disastrous because the injured parties would be able to sue you directly and go after personal assets such as your house and your money in order to recover the compensation to which they feel entitled. For this reason, the higher your bodily injury liability policy is, the more protected you and your personal assets (cash, wages, house) will be in the event that you cause a car accident.

Property Damage. Property damage coverage will pay for the property damage of others due to an accident that you have caused. The $100,000 property damage policy shown above is an excellent policy because 90% of vehicles will be less than $100,000 to fix or replace. As a result and assuming your insurance company accepts fault for an accident on your behalf, this policy would protect you from property damage lawsuits.

Underinsured/Uninsured Motorist. This policy is also known as uninsured/underinsured motorist bodily injury. This policy will protect you if you are injured in a car accident and the other driver is uninsured or underinsured. In the scenario wherein you are injured and the other driver is uninsured, having an underinsured/uninsured motorist policy would enable you to receive compensation from your own insurance company for your medical bills, injuries, lost wages, and pain and suffering. If you did not have an uninsured/underinsured motorist policy and you were injured by an uninsured driver, you would have to sue the driver directly and hope that the at-fault driver has assets that you can seize in order to compensate yourself for your bodily injury claim. And if the at-fault driver has 0 assets to go after, then you would be completely out of luck. That is precisely why you need to include an underinsured/uninsured motorist coverage in your auto policy.

Uninsured motorist bodily injury coverage is an absolutely crucial policy because while you may be in complete control of your own driving behavior, you cannot control what other drivers do when you’re on the road. And if you get hit by a negligent driver who is uninsured, you can potentially be putting yourself in extreme economic distress if you don’t have an uninsured motorist bodily injury policy to cover your medical treatment and medical bills.

An underinsured motorist bodily injury policy is often included with an uninsured motorist bodily injury policy and is beyond the scope of this blog entry. However, a competent personal injury would be ready and eager to explain this policy to you in the unlikely event that you get into a car accident.

Collision. Unlike the property damage coverage which pays for the property damage of others, collision coverage will pay for your vehicle’s property damage caused by another vehicle. Depending on your policy, collision coverage might not cover damage to your vehicle caused by acts of God such as hail, mudslides, etc.

Most of the time, if you wish to use your collision coverage to repair your vehicle, you will have to pay a deductible up front. However, once the other driver’s insurance company accepts fault for the accident, your insurance company will recover your deductible payment and refund it back to you. In some instances, if the other driver’s insurance company accepts fault for the accident early enough in the process, your insurance company may even waive your deductible. Collision coverage is extremely vital if you wish to protect your car from damage or a total loss. Collision coverage is especially important when the other driver is uninsured.

Comprehensive. Comprehensive coverage pays for damage to your vehicle that is not caused by another automobile. As such, comprehensive coverage will pay for damage caused by Acts of God such as hail, sleet, snow, fire, mudslides, etc.

Medical Payment. (not shown in the policy above). Medical payment coverage will pay for any medical bills that you incur as a result of medical treatment stemming from a car accident. The great thing about medical payment coverage is that, unlike uninsured bodily injury coverage, you do not have to demonstrate that the other driver is uninsured in order to utilize your medical payment coverage. You only need to demonstrate that you have been injured and that you incurred medical bills as a result. Medical payment coverage is also a great option if your health insurance does not cover urgent care visits, ER visits, or chiropractic visits. As such, you can think of medical payment as supplemental health insurance that can be used to pay for medical treatment stemming from car accidents. Fun fact: medical payment coverage can also be used to obtain extra $$$ to pay your medical bills if the at-fault insurance company doesn’t give you enough money to cover your medical bills and attorney’s fees.

As long as you follow the guidelines provided above, we have no doubt that you and your loved ones will be able to choose an auto insurance policy that will protect you in the unfortunate event of a car accident. If you have any other questions about this topic, feel free to contact the Law Office of Brian Nguyen, Professional Corporation.

© The Law Office of Brian Nguyen, Professional Corporation 2025 | All rights reserved.

DISCLAIMER: The information on this website is for general information purposes only. Nothing on this site should be taken as legal advice for any individual case or situation. This information on this website is not intended to create, and receipt or viewing of this information does not constitute, an attorney-client relationship. Information provided on the website is provided “as is” without warranty of any kind, either express or implied, including without limitation, warranties of merchantability, fitness for a particular purpose or noninfringement. Moreover, the mere act of using this website to contact the Law Offices of Brian Nguyen does not, by itself, create an attorney-client relationship.